Learning about money management from childhood is essential for the development of sound financial skills in the future. Teaching children about the importance of money not only gives them an early understanding of their value, but also inculcates healthy financial habits. In this article, we will explore various methods of teaching children about money, addressing its relevance, as well as providing practical advice and useful resources.

Introduction

Effective management of money is a crucial skill that significantly influences people's quality of life. Therefore, providing children with the necessary tools and knowledge to understand and manage money from an early age is crucial. In this article, we will present clear and effective strategies to teach children about the importance of money, developing their understanding of the value of work, savings, investment and responsible financial decision-making.

History and Background

To understand the importance of teaching children about money, it is essential to explore the origins and evolution of the monetary system. From bartering to the development of currency and banking, the history of money offers a unique vision of its role in society. In addition, we will examine historical cases that highlight the influence of money on the economic and social development of civilizations.

Analysis in Deep

In analysing the importance of money in modern society, it is essential to address the benefits and challenges associated with its management. In addition, we will provide relevant statistics, examples of case studies and testimonies that illustrate their impact on daily life. Various perspectives will be explored on the subject, offering a complete picture of the role of money in contemporary society.

Comprehensive review

The practical application of concepts linked to money, such as savings, budget and investment, highlights the importance of acquiring financial skills from childhood. This section will explore effective strategies to teach children about money, highlighting best practices and different educational approaches. In addition, we will provide a detailed assessment of the positive and negative aspects related to the management of money in childhood.

Comparative analysis

The interwovening of the terms of teaching, children and the importance of money reveals the importance of a comprehensive approach in addressing financial education in children. We will compare and contrast these elements to highlight similarities, differences and possible synergies between them. Through detailed examples, we will illustrate how education about money can adapt to the specific needs of children, promoting meaningful and lasting learning.

Practical Tips and Accessible Tips

By providing practical advice, we will offer clear and effective strategies to teach children about money. We will organize the information in numbered listings for easy understanding, including step-by-step guides and detailed explanations. These practical advices will be supported by solid evidence and real experiences, highlighting their viability in everyday situations.

Industry Perspectives and Expert Reviews

The detailed analysis of industry perspectives and expert views on the subject of financial education in children will provide a unique vision of current and future trends. Through interviews and expert appointments, we will explore the implications and forecasts related to the teaching of children about money, highlighting its importance and future opportunities it offers.

Case Studies and Real Life Applications

Detailed case studies will allow for the practical application of financial education in children. We will analyze results and lessons learned, presenting examples of different industries or contexts that highlight the effectiveness of teaching children about money. Real cases will provide a tangible understanding of the benefits of early incorporation of financial concepts into children ' s education.

Future Trends and Predictions

Reviewing emerging trends related to the teaching of children about the importance of money will allow us to glimpse the future of financial education in children. Based on current data and expert opinions, we will explore future predictions, potential challenges and evolving opportunities that will impact the way children learn about money.

Conclusions

In short, teaching children about the importance of money is a valuable investment in their future financial well-being. In an integral way, we have explored different approaches, highlighting the relevance and benefits of early financial education. By equating children with strong knowledge of money management, a sound financial base is promoted that positively influences their adult life.

Frequently asked questions

Why is it important to teach children about money from an early age?

It is essential to inculcate healthy financial habits from an early age so that children acquire a solid understanding of the value of money and develop financial skills that will serve them throughout their lives.

What are some effective strategies to teach children about money?

Incorporating practical activities, such as assigning them simple financial tasks, setting savings targets and providing examples of everyday situations related to money, are effective strategies to teach children about the importance of money.

How can I teach children about money management in a fun way?

Using money-related table games, creating a savings reward system and planning simulated shopping activities can make learning about money management fun and attractive for children.

What is the role of parents in the financial education of children?

Parents play a key role in shaping responsible financial behaviour and providing opportunities for children to learn about money management through practice and guidance.

What impact does financial education have on children in the future?

Financial education in childhood has a significant impact on the development of healthy financial habits, informed decision-making and the ability to face potential financial challenges in adult life.

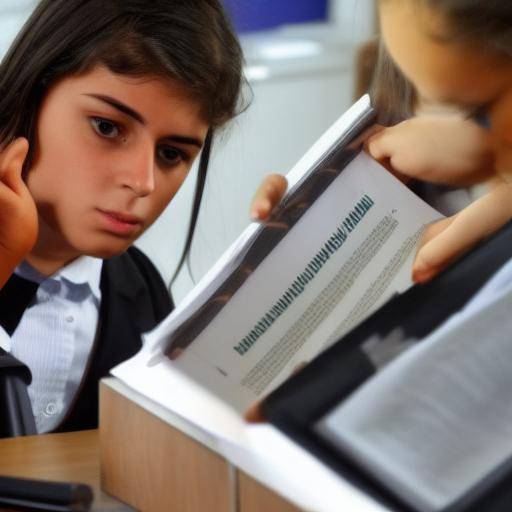

What is the best way to address money teaching in a digital era?

Integrating interactive financial tools and applications, reviewing family costs and budgets, and teaching children about online security and digital shopping are important aspects to consider when addressing financial education in a digital age.

In conclusion, teaching children about the importance of money is a valuable commitment that shapes their understanding and financial skills. The combination of effective strategies, interactive resources and models to be followed will lay the foundation for a solid financial future. This article provides a comprehensive guide on how to address financial education in children, emphasizing the importance of equipping children with a sound understanding of money to promote their financial well-being throughout their lives.